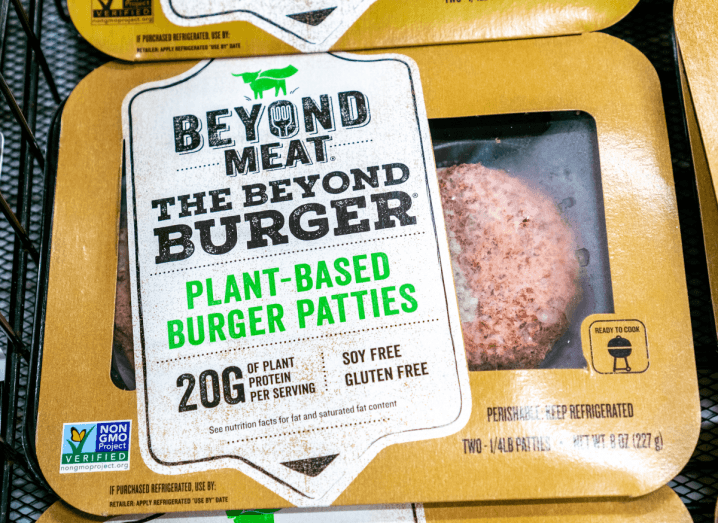

Despite Plant Based Alternatives Becoming More Common, It Has Not Been Enough

This means that without reducing the consumption of animal products like beef, chicken, and pork, we may not be able to meet the climate goals that are necessary to reverse the damage we’ve created.

In order to cut emissions, it’s necessary to slow the decrease in biodiversity and ensure food security for our world’s growing population. A way to do this is to reduce meat and dairy consumption and change the way it is produced as well.

While a lot of meat alternatives have been introduced, the fact remains that meat consumption has not decreased enough to actually bring down agricultural emissions.

That means that meat and animal product prices will have to increase, and one of the best ways to do this is by introducing a meat tax.

Animal Protein Sources

According to IFLScience: “the average retail price for meat in high-income countries would need to increase by 35%-56% for beef, 25% for poultry, and 19% for lamb and pork to reflect the environmental costs of their production. In the UK, where the average price for a 200g beef steak is around £2.80, consumers would pay between £3.80 and £4.30 at the checkout instead.”

Some countries like the Netherlands and Germany were already considering implementing a meat tax, but these plans were delayed since food crises increased dramatically due to the war in Ukraine.

Tractor

However, that doesn’t mean that sometime in the future a meat and dairy tax won’t become inevitable in order to curb the growing threat of agricultural emissions.

Additionally, as meat and dairy will become more expensive, it’s important that sustainable and healthy plant-based alternatives will become more affordable. Revenue generated from the meat tax can help reduce value-added taxes on healthy fruits like vegetables, fruits, and grains, which will help lower income households balance spending less while eating healthy.

What do you think about a potential meat and dairy product tax? Are you in favor or do you think there is a better solution out there?

Meat Consumption Causes A Lot Of Environmental Damage